Efficiency

It is often said that a tournament on robin-round system is fairer because it rewards regularity. Knockout tournaments carry the imponderable (not to say luck or bad luck), as idiosyncratic events can play a key role in the match and ultimately dictate the outcome of the tournament. Sometimes, the smaller club, that made modest investments, score from a corner, only defend the whole rest of the game and then the season ends for the big clube that made high investments and was declared one of the favorites. In the robin-round system, even if it happens, teams have more opportunities to recover unearned points from lost matches.

But the truth is that even robin-round tournaments have their distortions. And it is not because of their format, but something that takes place in almost every league in the world: money attracts talent. The top talented players are playing for the richest clubs in the world, that's a fact. I'm sorry to disappoint someone, but the love for a club goes as far as the money can support that relationship. And the more talented a group of players are, the bigger the chances of winning trophies; in football, money brings happines. There is absolutely nothing wrong with that. But when we compare the sports performance of clubs, we need to weigh how much each club invested, so we can have a fair evaluation. Comparing the performances of Flamengo and Chapecoense in Brasileirão, or Barcelona and Eibar in La Liga, without any weighting on spendings, is to make a completely distorted analysis of what really impacts the final position of the table. This is the first post of series I will do about efficiency, sports performance, Operating Costs and clubs incomes.

Before diving into efficiency, we need its definition: the hability of achieving the best yields with the least expense. In this study, we are going to evaluate the efficiency of brazilian clubs by relating their sporting performance, using the Brazilian League as a reference, and their respective Operating Cost, available in their respective balance sheets, for the period of 2009 to 2018.

So we can compare the Operating Costs of the clubs in a timeless way, we need proper price index for that, because it will require the spendings at constant prices to compare. Here, we will use our Brazilian Football Price Index, or simply put, BFPI. With it, we will deflate all Operating Costs to 2009 values, naming it Deflated Operating Costs. After the conclusion, there is all the explanation of how we did to get that index.

Conditional Expected Value of Points

To evaluate the efficiency of clubs, we will use a very simple model, but quite intuitive. The Model of Conditional Expected Value of Points is based on the difference between the points earned by the clubs and the number designed by the model (what we call the conditional expected value), given the Operating Cost and the number of points obtained in the Brazilian League. For the ones interested in the math side, it is a simple lin-log model, given by the regression:

where, \(y_t\) is the set of points earned by clubs for each year, \(x\) represents the Operating Costs respective to each club and year, \(\beta\) is the parameter to be estimated and \(\epsilon\) is the white noise term. The lin-log model can be interpreted as it follows: an increase of 1% in \(x\) causes a variation of \(\beta_1\) unities in \(y\), keeping everything else constant.

This equation tells us how much a club needs to invest in order to obtain a certain number of points in the Brasileirão. Example: for a given Operating Cost of R$ 100 million, the conditional mean is approximately 59 points. Given the recent record of the brazilian league, a clube that invest R$ 100 million gets 59 points. The more points the club gets with this level of financial investment, the bigger their efficiency. Therefore, we measure the efficiency here in relation to the financial potential of each club. The app below synthesise those informations.

Results

In the results tab, the table displays the clubs ordered by their Total Efficiency of the observed period. The stat Efficiency is the sum of all obtained points, less the Expected Points given the Operating Cost (estimated by the model). Thus, Total Efficiency is the sum of Efficiency for all years that the club took part in the league. The Mean Efficiency is the mean for the Efficiency in the period 2009-2018.

Based on the Total Efficiency, the most efficient club is Athletico Paranaense, that earned 56 points more than all other clubs with the same Operating Cost in the nine Brasileirão disputed between 2009-2018, followed by Grêmio and Cruzeiro. In fact, Grêmio and Cruzeiro have excelled in the Brazilian League, maintaining regularity at the top of the table and most often ending better in the championship than Athletico. However, here, we are evaluating the performances of the clubs according to how much was their Operating Cost, and that places Athletico top given their modest spendings, compared to the clubs that usually fight for the top of the table, and, of course, their results. For clubs with modest investments, Athletico Paranaense is a case of success in efficiency.

Given the level of efficiency shown by Athletico Paranaense over the past nine years, if the club invested the same amount that Palmeiras invested last year ($ 162 million, 2009 prices), they would earn 71 points in Brasileirão, on average. Of course, this counterfactual exercise requires some unrealistic assumptions to be made (assuming constant marginal returns, for example), but it gives an idea of the superiority of Athletico's resource allocation over other clubs. If the clubs were publicly traded, we already know the stocks from which clubs we should buy.

Conclusion

Clubs have different levels of income and investments, and that makes them have distinct goals inside a tournament, specially the ones with robin-round system and relegation. The Conditional Expected Value of Points is a simple model, but highly intuitive to assign efficiency to the performance of the clubs. However, although this study is important, as it contributes to a virtually unexplored area in the Brazilian literature, some clarification is necessary.

The first one is related to the Operating Costs of brazilian clubs. Since 2003, there has been a law requiring clubs to disclose their Balance Sheets and Financial Results with greater transparency. However, the obligation to disclose financial reports does not impose homogeneity in the manner in which such data are disclosed. Thus, some data may contain different information, from club to club. We tried our best to get the data as uniform as possible (so we choose the Operating Cost of clubs for the study, not the payroll).

The second clarification concerns Fluminense and some other clubs that do not have the data available. We decided to exclude Fluminense for the entire period of partnership with Unimed, because much of the club's spending did not go to their own sheet, but to the sponsors, causing distortion in the club data. Some others, such as Ceará (2010 and 2011) and Atlético-GO (2010), were not found or were not published.

The last clarification is a Brazilian particularity. As there are so many games in the season, teams that play more than one tournament have to spare players eventually so they do not risk injury to their athletes. This usually happens with teams competing for the Libertadores, Copa do Brasil and the Brazilian Championship. The obvious option is to spare players in the Brazilian Championship, since a defeat in the other two can take the team out of that competition (knockout format). Teams that reach the final stages of knockout tournaments usually spare their players in the Brazilian Championship in a larger amount of games and therefore this can affect their performances. It happens every year. One of the possible ways to correct this would be by placing the other championships in the study as well. But that is for a next moment.

Inflação Setorial no Futebol Brasileiro

To build our Brazilian Football Price Index, we refer to the method used by Paul Tomkins, Graeme Riley and Gary Fulcher in the book Pay as you Play. In it, the authors created a sectoral inflation index for English football, called the TPI - Transfer Price Index. The index is composed by the evolution of the average price of traded players in English football. An example from the book:

Para construir o nosso Índice de Preços do Futebol Brasileiro, utilizamos como referência o método utilizado por Paul Tomkins, Graeme Riley e Gary Fulcher, no livro Pay as you Play. Nele, os autores criaram um índice de inflação setorial do futebol inglês, chamado de TPI - Transfer Price Index. O índice é composto pela evolução do preço médio dos jogadores transacionados no futebol inglês. Um exemplo do livro:

"Stan Collymore cost Liverpool £ 8.5 million in July 1995. The average transfer price for the 1995/96 season was £ 1.59 million, and for the 2008/09 season it was £ 5.35 million, giving inflated value of 236%. This suggests that Collymore's cost for the 2008/09 season was £ 28.5 million". (TOMKINS; FULCHER; RILEY, 2010).

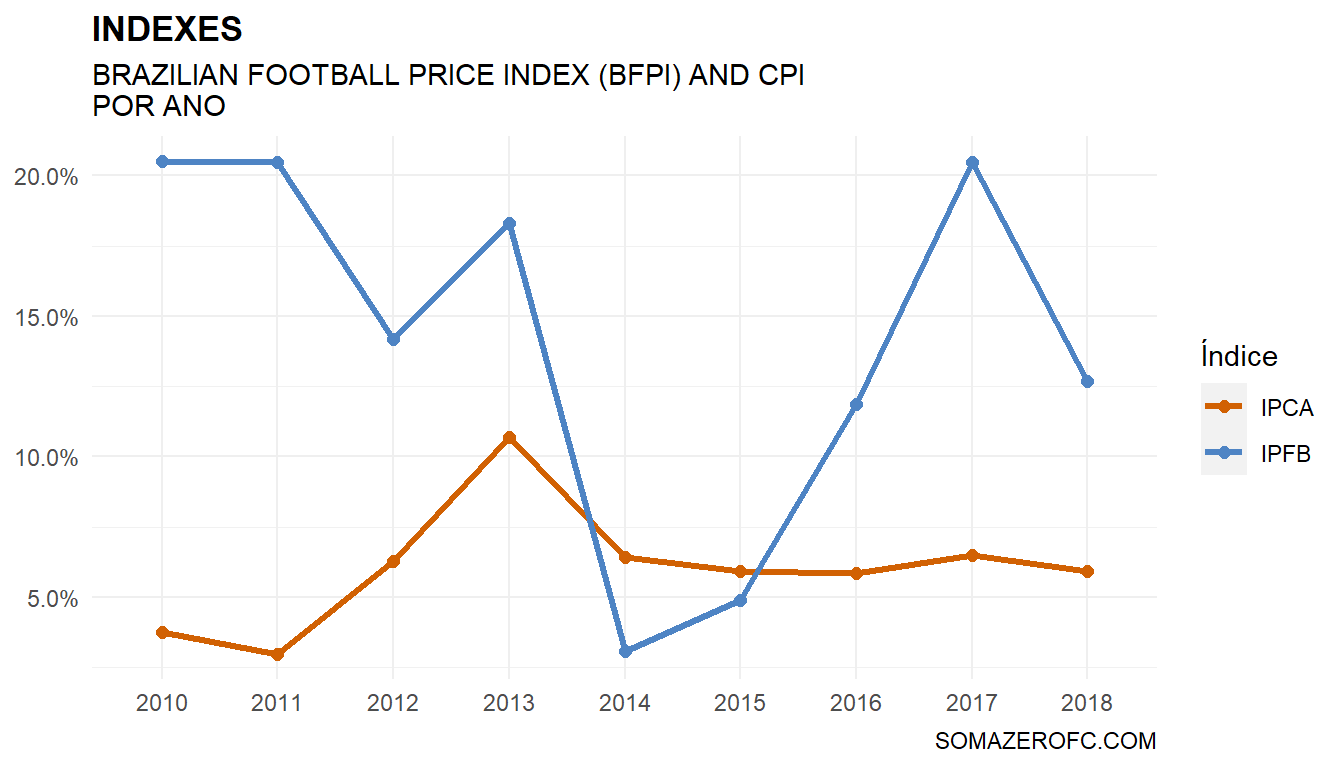

To do the analysis in the Brazilian context, we use the average operating cost per year as our Brazilian Football Price Index (BFPI). This is because transfer data is not homogeneously arranged on club balance sheets. This sectoral index of Brazilian football is important because, for example, the CPI, Consumer Price Index, measures the evolution of prices of a fixed basket of consumer goods and is not representative for Brazilian football inflation, as shown in the Chart Indexes.

Ultimately, we use our BFPI to deflate all values of the Operating Cost of the clubs, and thus we have all the values in 2009 prices (first year of our sample), which allowed us to compare all the performances and spendings in a timeless way.